harrisburg pa local services tax

The Governors Center for Local Government Services GCLGS is a one-stop shop for local government officials and provides a wealth of knowledge and. 2 South Second Street.

Tax Collection Borough Of Patton

The name of the tax should be changed from the Emergency and Municipal Services Tax to the Local Services Tax Deadlines follow.

. DCED Local Government Services. Great service with great pricing. 1601 N 4th St.

Dauphin County Administration Building - 2nd Floor. If a municipality and school districts combined Local Services Tax rate is more than 10 employers must withhold the tax based on their number of annual payroll periods and are. The Local Services Tax LST for cities in Pennsylvania is withheld on a mandatory basis from the salaries of employees whose duty stations are located in the cities listed below.

Local Income Tax Requirements for Employers. Revenue Department Releases September 2022 Collections. Coupons Deals Explore Cities.

Harrisburg PA Pennsylvania collected 42 billion in General Fund revenue in September which was 1358. Home Services Property Taxes. County Real Estate taxes are collected by the Dauphin County Treasurer.

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local. Harrisburg PA 17112 CLOSED NOW. The provision would extend Harrisburgs ability to levy an enhanced Local Services Tax on all people who work in the city for 15 years.

Harrisburg Pennsylvania 17120 United States. The local tax filing deadline is April 18 2022 matching the. We make it our mission to aid all customers with spectacular taxi service that always arrives on time.

See reviews photos directions phone numbers and more for the best Tax Return Preparation in Harrisburg PA. Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone. Tax Return Preparation Tax Return Preparation-Business Taxes-Consultants Representatives.

And our around-the-clock services are extremely convenient for a variety of people whose. The first 10 years at 3-per-week or 156. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in.

71 rows Harrisburg Pennsylvania 17120 United States. The name of the tax should be changed from the Emergency and Municipal Services Tax to the Local Services Tax Deadlines follow. Contact Us Capital Tax Collection Bureau 8391 Spring Rd Suite 3 New Bloomfield PA 17068 Phone.

The City Treasurer collects current year City Real Estate taxes and School District Real Estate taxes.

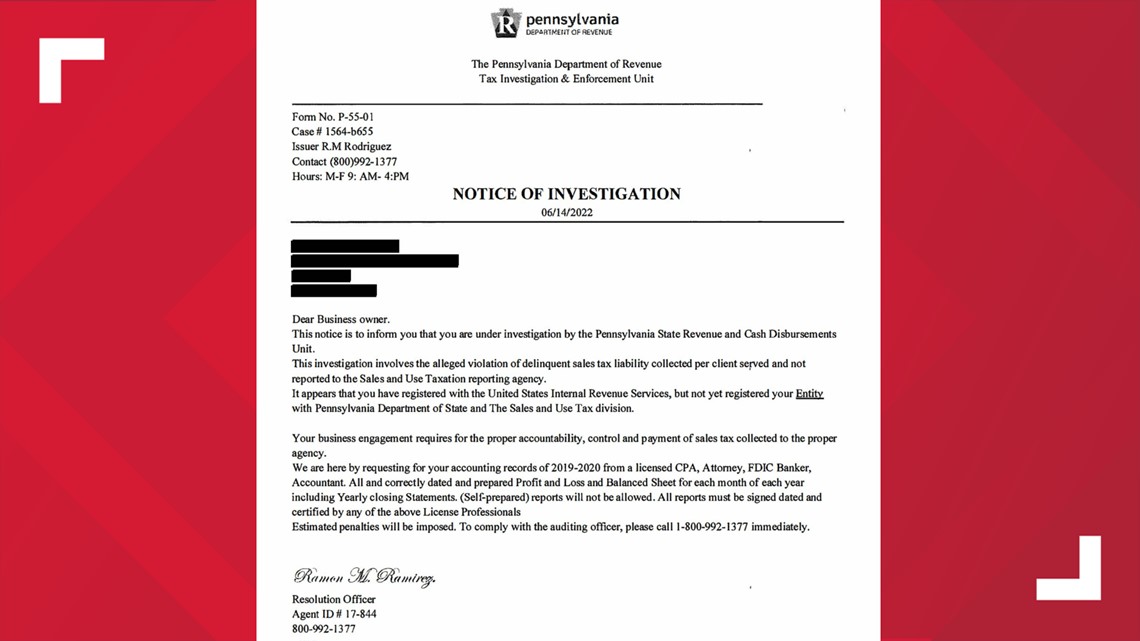

Officials Warn Of Scam Targeting Pa Business Owners By Impersonating The Department Of Revenue Fox43 Com

Harrisburg Charts New Fiscal Future With Extended Tax Authority Bond Buyer

Pa Department Of Revenue Homepage

Local Services Tax Rates Berks Earned Income Tax Bureau

Tax Accountant For Business Tax Savings In Harrisburg Pa

Local Services Tax Faqs City Of Harrisburg

Pa Dept Of Revenue Warns Businesses Of New Scam

Harrisburg School District Passes 2022 23 Budget Includes Property Tax Increase Theburg

Harrisburg Pennsylvania Wikipedia

Finding Revenue Can Cities Like Harrisburg Survive Pennlive Com

Harrisburg Pa Retirement Income Planning

The 10 Best Tax Preparation Services In Harrisburg Pa 2022

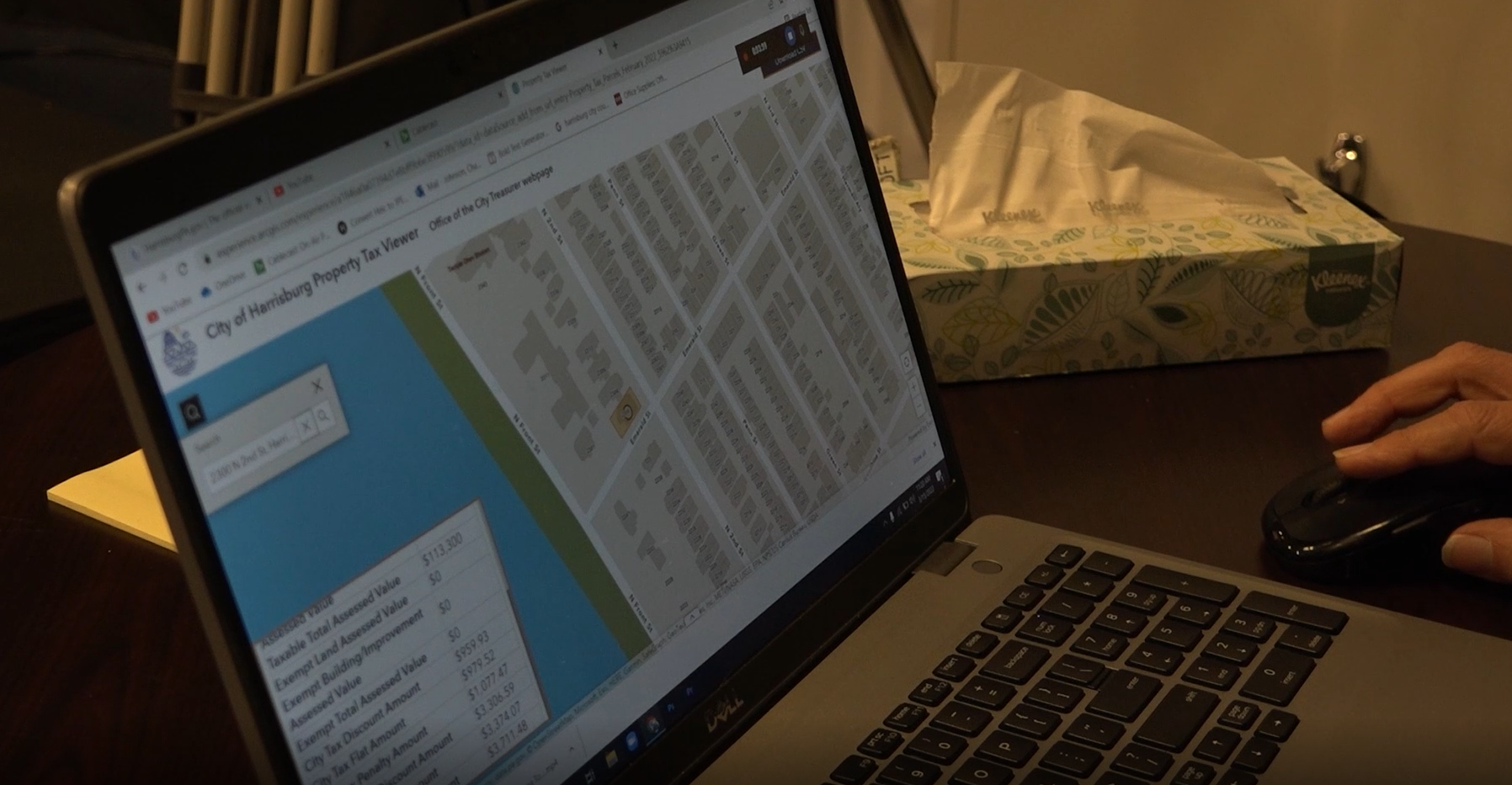

New Property Tax Viewer On Harrisburgpa Gov Gets You Ready For Tax Season City Of Harrisburg

Harrisburg Pa Tax Professionals Gift Cpas Expert Small Business Advisors In Central Pa

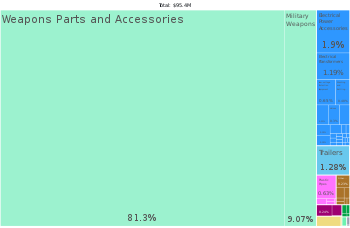

Non Glamorous Gains The Pennsylvania Land Tax Experiment

Gov Wolf Signs Bill That Allows Harrisburg To Retain Elevated Tax Rates Theburg

All Your Questions About Harrisburg S Act 47 Status Answered Theburg